Mortgage calculator with escrow and extra payments

The Early Loan Payoff Calculator is another loan payoff calculator that will help you figure out how much extra to pay each month to pay down the loan by a desired years or months. The cushion amount cant exceed two monthly escrow payments.

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Make payments weekly biweekly semimonthly monthly bimonthly quarterly or.

. Your mortgage lender might take a certain percentage of your monthly payment for an escrow account. For those who want to know exactly how our calculator works we use the following formula for our mortgage calculations. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI.

Todays national mortgage rate trends. Found on the Set Dates or XPmts tab. Mortgage Payoff Calculator 2a Extra Monthly Payments Who This Calculator is For.

Check out the webs best free mortgage calculator to save money on your home loan today. Account for interest rates and break down payments in an easy to use amortization schedule. While private lenders who offer conventional loans are usually not required to do that the FHA requires all of its borrowers to pay taxes along with their monthly mortgage payments.

This gives the seller extra confidence in picking your offer over the competitions. Borrowers who want an amortization schedule or want to know when their loan will pay off and how much interest they will save if they make extra voluntary payments in addition to their required monthly payment. Lowers monthly mortgage payments so that theyre more affordable.

CalHFA Mortgage Insurance Services HARP Eligible Program. With 52 weeks in a year this amounts to 26 payments or 13 months of mortgage. About Dates Interest Calculations - In the real world the time between the mortgage origination date and the first payment due date will seldom be equal to the payment frequency.

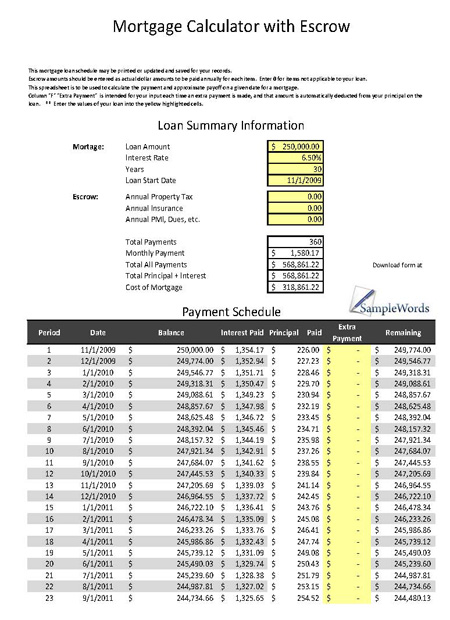

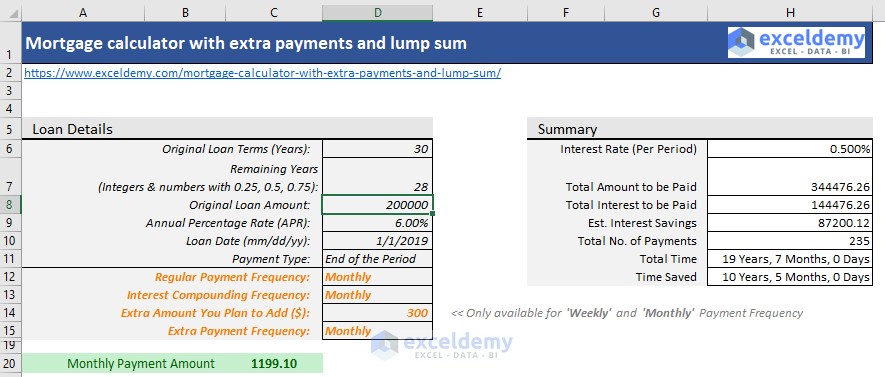

There are optional inputs in the Mortgage Calculator to include many extra payments and it can be helpful to compare the results of supplementing mortgages with or without extra payments. Our Excel mortgage calculator spreadsheet offers the following features. Shows total interest paid.

Homeowners who have experienced a financial hardship who took out a mortgage on or before January 1 2009. Lenders often roll property taxes into borrowers monthly mortgage bills. Extra Payments In The Middle of The Loan Term.

Allows extra payments to be added monthly. It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months. Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term.

To determine how much property tax you pay each month lenders. For example if you are 35 years into a 30-year home loan you would set the loan term to 265. Your mortgage can require.

A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. Our calculator includes amoritization tables bi-weekly savings. These fees cover things such as escrow costs title searches appraisals and.

Homeowners must have mortgage loans insured by CalHFA Mortgage Insurance on or before May 31 2009. Divide the breakeven timeframe months by 12 to calculate the number of years you need to make payments on the loan before realizing any savings from the refinance. A title for these calculator results that will help you identify it if you have printed out several versions of the calculator.

Make more frequent payments. How to Use the Mortgage Calculator. N Number of Monthly Payments for 30-Year Mortgage 30 12 360 etc How to Use Our Mortgage.

The calculator will then give you a rough estimate of your monthly mortgage payment. Make a mortgage payment get info on your escrow submit an. Whatever the frequency your future self will thank you.

Enter your loan information and find out if it makes sense to add additional payments each month. It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization. But as the total costs of homeownership add up and add to expenses such as making payments on other loans transportation and entertainment youll be glad you have an extra cushion of money in your monthly budget.

Use the Extra Payments Calculator to understand how making additional payments may save you money by decreasing the total amount of interest you pay over the life of your home loan. Paying Taxes With a Mortgage. Biweekly paymentsThe borrower pays half the monthly payment every two weeks.

P Principal Amount initial loan balance i Interest Rate. This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. Simply enter your purchase price down payment and a few other factors.

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. The calculator updates results automatically when you change. Keys to Consider When Calculating Potential Refi Savings.

First Payment Due - due date for the first payment. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. This calculator has a years before sell setting which is used to run both loans from present until that dateIf you do not plan on selling the home refinancing again at a later date or moving out until after the loan is paid off then set this figure to 30 years so it compares both scenarios after all payments have been made.

An escrow cushion is an extra amount above your mortgage payments that your lender or servicer is allowed to collect and hold. On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. The calculators results page will return a loan option best fit for your needs including the length projected rates.

Use our free mortgage calculator to estimate your monthly mortgage payments. Our mortgage calculator can help you determine what mortgage you can afford by taking simple information about your finances and prospective home to predict your monthly payments including your principal and interest rate. Field Help Input Fields.

Mortgage Closing Date - also called the loan origination date or start date. If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

M Monthly Payment. Churchill will cut the seller a check for 5000. Its a great.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. If you choose a mortgage with an adjustable interest rate or if you make. Your lender will manage the escrow account and submit payments for your property taxes and homeowners insurance when they are due.

Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions. The Math Behind Our Mortgage Calculator. Mortgage Payoff Calculator Cost of Living Calculator.

Use a mortgage refinance calculator to determine the breakeven point which is the number of months it takes for the savings to outweigh the cost of refinancing. How to Use the Mortgage Calculator. What This Calculator DoesThis calculator provides amortization schedules for.

Mortgage Calculator With Taxes Insurance Pmi Hoa Extra Payments Mortgage Payment Calculator Mortgage Calculator Mortgage

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator With Escrow Excel Spreadsheet

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

![]()

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Free Financial Calculators For Excel

Extra Payment Calculator Is It The Right Thing To Do

Extra Payment Mortgage Calculator For Excel

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Repayment Calculator

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Calculator With Extra Payments Free Excel Template